Swiggy underwent a UI-UX change last month, giving its app a new look. While the fresh design gave Swiggy a facelift, its Q1 FY26 financial numbers revealed an almost familiar picture – burn to grow.

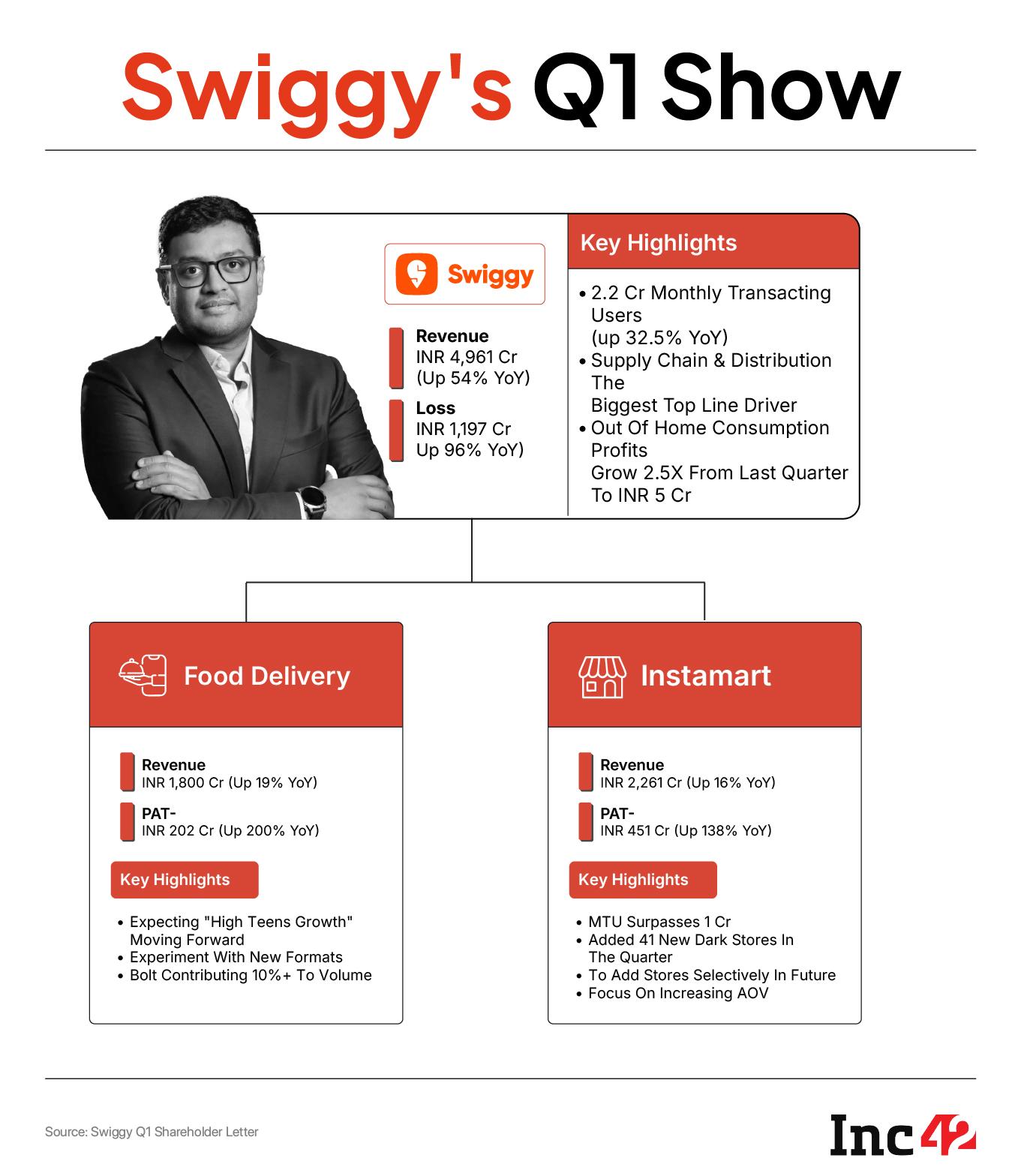

The company’s revenue grew, but so did its losses. The Bengaluru-based food delivery giant saw its operating revenue jump 54% YoY to INR 4,961 Cr in the first quarter of FY26, while net loss soared 96% YoY to INR 1,197 Cr.

Food delivery continued to be the backbone of Swiggy. Its gross order value (GOV) jumped 19% to INR 8,086 Cr. However, the food delivery segment’s margins took a hit on a QoQ basis due to an increase in delivery executive incentives, higher marketing spends, and a rise in discounts.

Consequently, the profit of the vertical declined to INR 202 Cr in Q1 from INR 220 Cr in the preceding March quarter. This is a red flag, as food delivery helps Swiggy offset the losses of its quick commerce arm Instamart.

However, the company brushed this off saying that the reduction in margin was seasonal. “… there is no structural change in the economics of the business, and we expect to continue to reap the benefits of higher monetisation and strong operating leverage going forward,” it said.

Instamart Continues To See Strong GrowthWhile the food delivery business is Swiggy’s key vertical, Instamart is gradually becoming an important driver of the company’s top line on the back of its rapid growth. With a 100% YoY GOV growth to INR 5,655 Cr, the quick commerce arm accounted for 40% of the company’s overall GOV in Q1.

Highlighting the growth of Instamart, Swiggy cofounder and group CEO Sriharsha Majety said, “Instamart has grown out of the shadow of food delivery as a standalone brand, with its GOV and user base at over 2/3rd of food delivery already.”

This growth has come on the back of the rapid expansion of Instamart’s dark store network. After adding 314 dark stores in the last quarter of FY25, Swiggy saw an addition of 41 new stores in Q1 FY26. Subsequently, the quick commerce vertical’s adjusted revenue zoomed 113% YoY to INR 859 Cr.

The introduction of Zepto’s SuperSaver-like feature, termed as MaxxSaver, in April 2025 helped Instamart increase its average order value (AOV) to INR 612 during the quarter under review from INR 487 a year ago.

Besides, Instamart’s continuous push for an increase in assortment resulted in its total order count rising to 17.6 Cr in the June quarter. More importantly, the addition of non-grocery categories, such as personal care and electronics, also improved margins on a sequential basis. While contribution margin improved to -4.6% in Q1 FY26 as against -5.6% in the preceding March quarter, adjusted EBITDA margin stood at -15.8% compared to -18% in the preceding quarter.

Despite the growth and improvement in margins, Instamart’s loss rose on a YoY as well as QoQ basis in Q1 FY26. Its adjusted EBITDA loss increased to INR 896 Cr, higher than the adjusted revenue during the quarter. This indicates that the company is far away from achieving profitability.

Meanwhile, its rival Blinkit, which forayed into quick commerce after Instamart, seems much closer to achieving profitability. Blinkit’s adjusted EBITDA loss was one-fifth of Instamart’s in Q1 despite having nearly 3X adjusted revenue of Swiggy’s quick commerce arm.

More importantly, Blinkit’s adjusted EBITDA margins are much better than that of Instamart’s. After reporting an adjusted EBITDA margin of -2.4% in Q4 FY25, the worst in four quarters, Blinkit’s adjusted EBITDA margin improved to -1.8% in Q1 of FY26.

Instamart also continues to trail Blinkit on other metrics. Despite the rise, Instamart’s AOV was behind Blinkit’s AOV of INR 669 during the quarter under review, which indicates the latter’s wide range of assortment. Blinkit also leads In terms of dark store network. It had 1,544 dark stores at the end of June quarter after the addition of 243 dark stores in Q1 as against Instamart’s 1,062 stores.

With its target of having 2,000 dark stores by December 2025 and the shift to inventory model expected to increase its margins, Blinkit looks better placed in the rapidly growing quick commerce market. Instamart, which is now adding dark stores selectively, will have to find a way not only to increase its market share in the competitive segment but also do so without cash burn so that it can cut its losses and move towards profitability.

Edited By Vinaykumar Rai

The post Blinkit Vs Instamart: The Gap Keeps Growing appeared first on Inc42 Media.

You may also like

Beautiful UK beach walk that ends at award winning fish and chip shop

Some Gazans given cash for food, but find few supplies to buy: UN

Universal Credit claimants risk 'committing fraud' for simple mistake

Mumbai News: 98% Wet Lease BEST Employees Vote For Strike Over Pay Disparity

Trump orders firing of labor statistics chief after weaker-than-expected jobs report