Banking on the Indian startup IPO frenzy, logistics tech provider Leap India has now set sail for D-Street. The 2013-founded company filed its Draft Red Herring Prospectus (DRHP) last week for an INR 2,400 Cr public listing.

Leap is primarily a pallet pooling player, enabling manufacturers to reduce their trucking and cargo costs by pooling their goods with other players. This ensures optimal capacity in the vehicles while also reducing the costs for manufacturers, who would otherwise have to pay the cost for the full load even for smaller shipments.

While the listing will comprise a fresh share sale of up to INR 400 Cr and an offer for sale (OFS) component of up to INR 2,000 Cr, the key question is how attractive a proposition Leap India really is.

Before we get to answering this, let’s talk about the company’s post-IPO vision. Leap India’s IPO playbook is clear — clean up the balance sheet and fuel the next phase of growth. The company plans to use a significant chunk of its fresh issue proceeds, nearly INR 300.1 Cr, to pare its borrowings, which stood at INR 873.6 Cr as of May 31, 2025.

By cutting debt, Leap India aims to ease interest costs, improve its debt-to-equity position, and gain greater financial flexibility. The rest of the capital will be used for general corporate purposes, giving the company room to strengthen operations and capture new growth opportunities.

Notably, the company benefits from strong structural support from the logistics sector, a growing palletisation market, and growing authority in the asset pooling segment. All of this may paint a rosy picture, but market analysts believe Leap India’s IPO will likely draw cautious optimism.

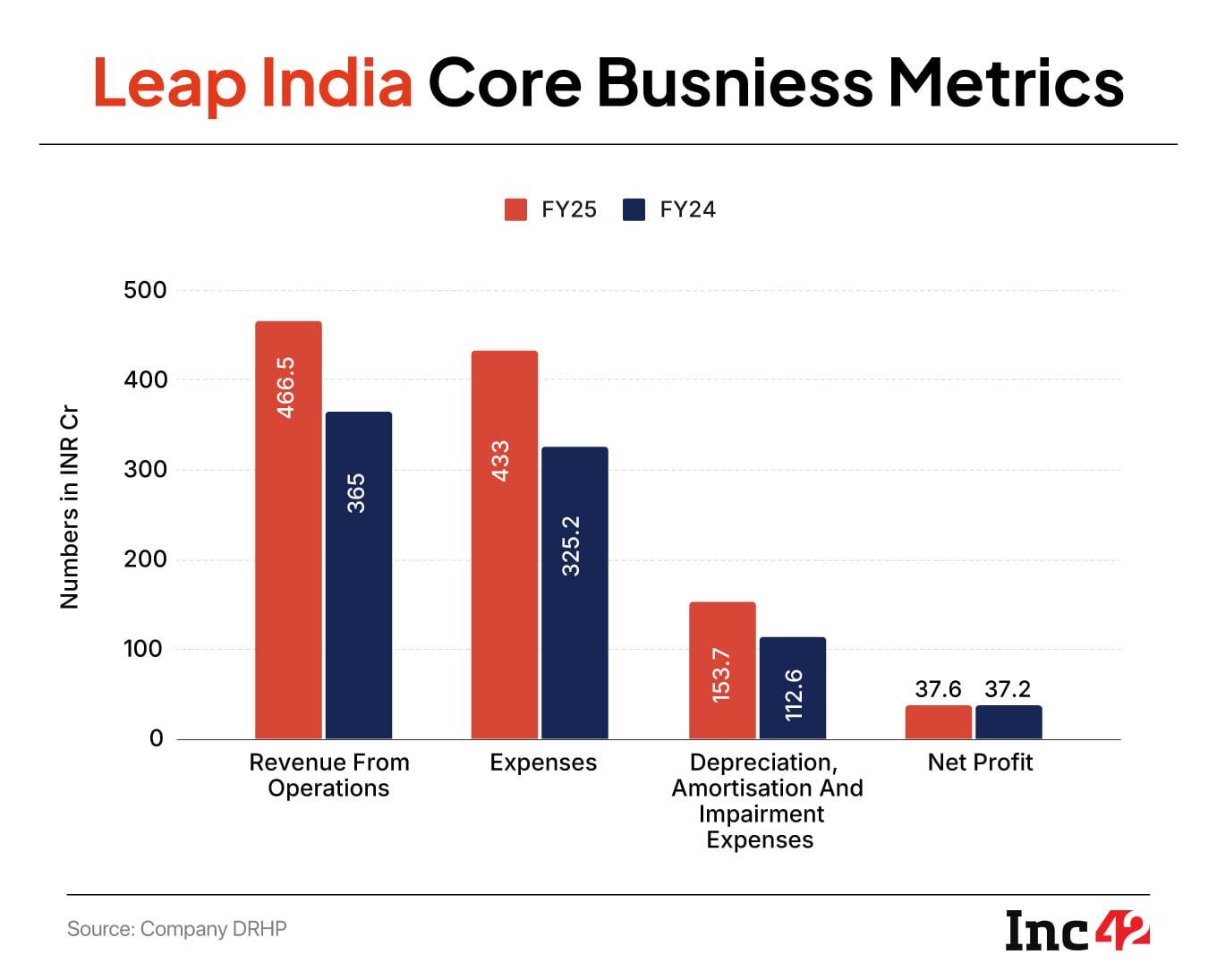

Why, you ask? Well, Leap India reported a flat net profit of INR 37.5 Cr in the financial year ended March 2025, compared to INR 37.1 Cr in FY24, despite enjoying strong revenue momentum.

“Investors may participate if valuations are sensible, but enthusiasm will likely be measured rather than euphoric,” analysts believe.

Sectoral Tailwinds Gather PaceSpeculations of a muted IPO response aside, industry tailwinds definitely work in favour of Leap India, which operates in the rapidly growing Indian pallet pooling segment.

Pallet pooling in logistics is a shared-service model where companies rent pallets from a central provider instead of owning them, ensuring standardised, reusable, and cost-efficient pallet availability.

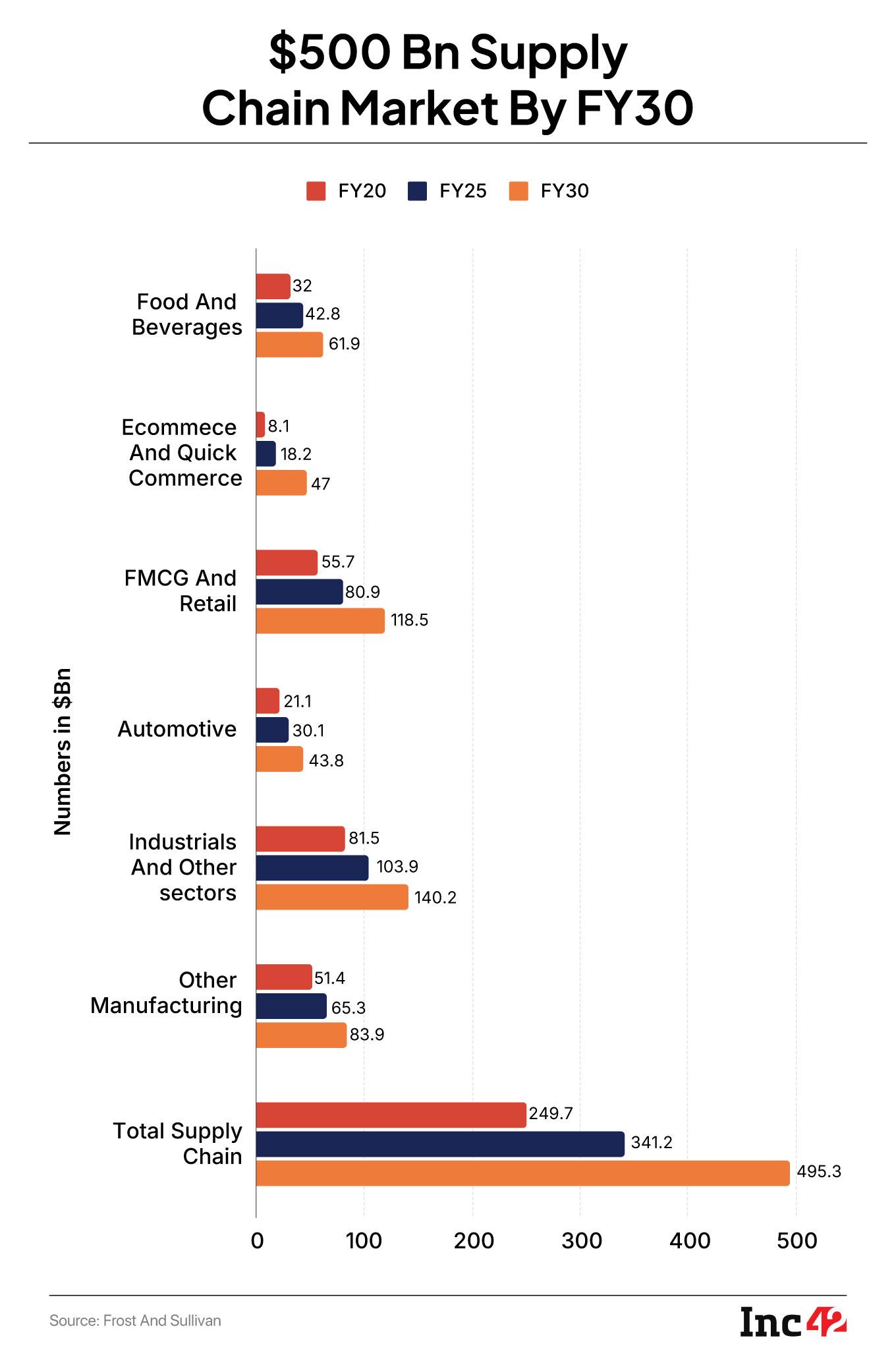

According to a Frost & Sullivan report for 2025, the Indian pallet pooling market is expected to grow at a robust CAGR of 13.6% between FY25 and FY30, driven by increased palletisation and deeper adoption of pallet pooling solutions. Despite the growth, pooled pallets currently account for a mere 9% of India’s total pallet market, highlighting substantial room for expansion.

Leap’s asset pooling model is increasingly being adopted by key industries looking to optimise logistics costs while ensuring the safety of goods during transportation and storage. Among these, the food and beverages sector stands out as the largest logistics spender, given its reliance on cold chain facilities and specialised handling.

According to the DRHP, Leap India had a total asset pool of 13.57 Mn as of March 31, 2025, deployed across a network of 7,747 customer touchpoints. Its customer base expanded from over 500 in FY23 to more than 900 in FY25.

Customer loyalty has been another strong suit for LEAP India, with churn among its top 100 customers staying exceptionally low. The churn rate stood at just 0.19% in FY25 compared to 0.75% in FY24, while FY23 saw no attrition at all.

The company further consolidated its position in the asset pooling industry through the acquisition of CHEP India in January 2025.

“Logistics and supply chain industry in India is getting strong, long-term support from rising manufacturing activity and low palletisation levels,” Sourav Choudhary, MD of Raghunath Capital, said.

There’s huge room for growth in pallet usage, and companies like Leap India, which lead in pallet pooling, stand to benefit.

On the core business side of it, Leap India moved from near breakeven in FY22 to significant profitability by FY24. Revenue climbed from INR 273.5 Cr in FY22 to INR 480.2 Cr in FY24, while PAT surged from INR 0.2 Cr to INR 37.3 Cr over the same period. EBITDA margins also improved steadily, reflecting higher asset utilisation and operational leverage.

This trajectory underscores the company’s ability to scale its operations efficiently within the asset-pooling business, according to analysts.

The company generates its primary revenue from leasing and rental income from a fleet of pallets, foldable large containers (FLCs), crates, and bins. Complementing this are value-added services such as asset repair, sanitisation, maintenance, and reverse logistics.

However, the business is not without risks. Operationally, it remains asset-intensive, requiring continuous investment in pallets, FLCs, crates, and repair infrastructure. Managing such a large pool of assets across India carries inherent risks, including potential loss, theft, or damage, which could negatively impact profitability.

Customer concentration is another concern, as a significant portion of revenue comes from a handful of large clients, leaving the company exposed to shifts in demand or contract renegotiations.

Financially, Leap India has taken on significant debt to fund its expansion, leading to repayment obligations and interest costs, while also requiring heavy upfront capital expenditure to acquire assets that generate revenue over time. Profitability is also sensitive to asset utilisation — under-utilised assets could weigh on margins, particularly if demand growth slows.

Moreover, other risks include increasing competition from logistics and packaging players, economic slowdowns affecting FMCG, retail, or automotive sectors, and reliance on the continued expansion of ecommerce volumes. Hence, valuation is expected to be a defining factor for Leap India’s IPO reception.

Not really. While Leap India commands leadership in the asset pooling segment and operates with an asset-light model, investors are cautious due to the flat net profit in FY25 and relatively modest returns on equity.

Asset-light peers such as TCI Express and Mahindra Logistics have historically commanded higher multiples, thanks to their scalability, lower capital intensity, and steady revenue streams.

In FY25, TCI Express posted revenue of INR 1,221.7 Cr and net profit of INR 85.8 Cr. On the other hand, Mahindra Logistics posted a revenue of INR 6,105 Cr against a loss of INR 35.9 Cr.

By contrast, companies with heavier asset bases or slower profit growth typically trade at a discount, even when their top line looks strong.

“The market will reward Leap India for its leadership, but pricing will need to be realistic. Investors are not just looking at revenue growth, they are scrutinising the path to sustainable profitability and returns,” a market analyst at a leading brokerage said.

For Leap India, the challenge also lies in translating sector tailwinds and top-line growth into consistent bottom-line expansion. While revenue and EBITDA have grown impressively, net profit has been flat due to rising depreciation and finance costs.

This implies that investors will demand clarity on operating leverage, asset utilisation improvements. Moreover, structural comparisons with listed peers will play a significant role in market perception. “Asset-light peers like TCI Express and Mahindra Logistics trade at higher multiples; asset-intensive players typically command a discount. Unless pricing reflects these risks, enthusiasm could be tempered,” Choudhary said.

Unless the IPO is priced to reflect both the growth story and these operational and profitability risks, enthusiasm is likely to be measured rather than exuberant.

Investors may view the issue with selectivity, balancing the company’s market dominance and structural tailwinds against flat profits and capital intensity pressures.

[Edited by Shishir Parasher]

The post Leap India IPO: Flat Profit To Create Dilemma For Investors? appeared first on Inc42 Media.

You may also like

Emmerdale fans fume over 'cruelest twist ever done' after chilling Mack scene

Zara McDermott left 'scared' and 'petrified' after almost being arrested in Thailand

Daniel Levy gives up second powerful role after bombshell Tottenham exit

Italy's hidden gem that's 27C in September and less crowded than Amalfi Coast and Tuscany

Mumbai: Fire breaks out at firecracker shop in Malad, no loss of lives, says police